The evolution of the drone has been a rapid one. Not long ago they were the tech aficionado’s toy, a step up from model aeroplanes.

More widespread applications were proposed early on, but to most people, the idea of food and mail deliveries by drone sounded like science fiction.

The technology and the markets have come a long way, but even the sector’s most enthusiastic advocates are still cautious about drones entering the mainstream.

“We need better enablement from the government, and particularly an adequately resourced Civil Aviation Authority,” says Paul Luen, CEO of commercial drone company, COPTRZ.

“They are doing a really good job with the resources available, but they need to be more agile with the ability to review and approve operational safety cases much faster. Without that, they cannot enable all of the drones’ major use cases ‘beyond visual line of sight’, where some of the real economic value can be unlocked. We need a slightly more pragmatic view of risk management.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataLuen argues that while the regulation of drones needs to align with manned aviation standards, there needs to be a recognition that at times these rules can be “overkill”.

“Only then will we start to catch up with our counterparts in France, Germany, Italy, and further afield in places like Japan where they have been more agile and progressive in enabling the industry,” Luen says.

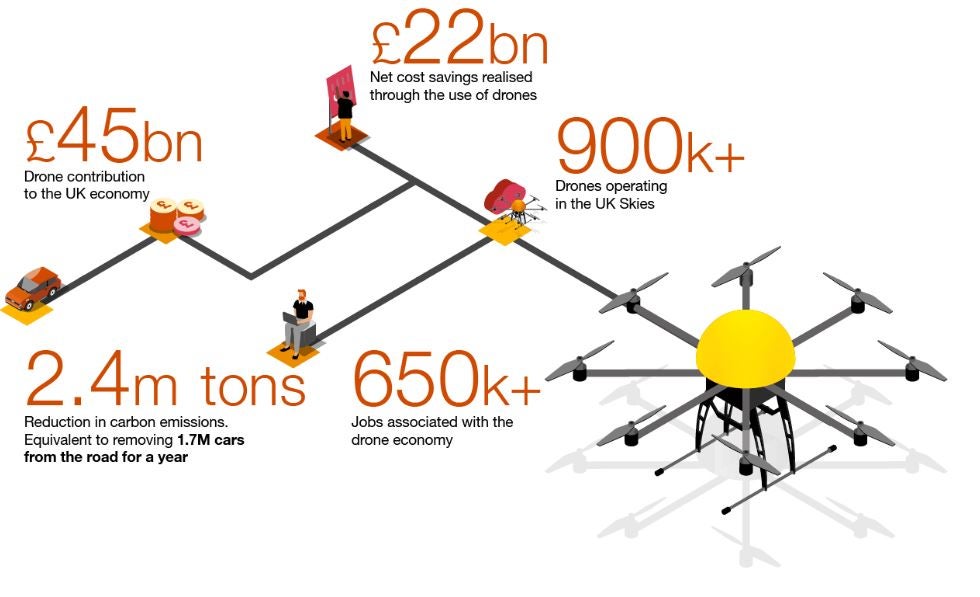

If the industry is enabled, Luen says there is potential for as many as 650,000 jobs to be created in the industry, pointing to PwC’s Skies Without Limits v2.0 report.

Also see, GovUK’s Commercial drones saving money and saving lives in the UK

Despite the hurdles that certainly still exist, there is already a great deal of optimism around the potential of drones.

“I feel that it is going to be coming into the mainstream pretty soon,” says Ben How, Key Account Manager at Bluestone Leasing, COPTRZ’s finance partner. “Historically we have seen drones are big in the surveying industry. We are seeing it a lot more in the security sector too now, creating opportunities for more industries, and in the future, we will see more applications appear on the transportation side.”

How points to discussions around applications for drones in the freight sector, using Britain’s old canal networks for drones that could potentially carry as much as half a ton at a time. While that might remain a future application, for now, drones are increasingly used in security, surveying and other photography, as well as by public sector police forces.

“If there is a stolen car or a burglary, the police can send up a drone instantly, using heat maps to tell exactly where a person is,” How says.

Bluestone Leasing began financing drones three years ago, after noticing the rapid expansion in the sector.

“What saw was that the sector was relatively new, growing at a rapid rate and we wanted to be a part of that,” says How. “We are good at understanding the markets, seeing the gaps we are not serving, and we knew that the drone sector was going to be huge in the future. In the next five years, it will be much more common.”

Of course, the aviation sector is no stranger to innovation, and as a result, it has a history of being at the cutting edge of finance.

“The aviation industry has, since the first powered flight in 1903, been at the forefront of innovation,” points out Andrew Blundell, Managing Director of Close Brothers’ Aviation and Marine team. It would be natural, therefore, to assume that the development of new drone UAV (unmanned aerial vehicle) and EVTOL (electric vertical take-off and landing) aircraft would be a natural evolution of this.

Technology and capability are increasing at a rapid pace, although several factors stand in the way of mass adoption into potential applications.”

A well-regulated sector

As Luen has pointed out, a real challenge in any truly innovative sector is that there is often a regulatory lag as the rules and laws catch up with what the technology is capable of.

From a financial point of view, this can even put an added regulatory burden on lenders. “We have to do extra due diligence in our transactions and ensure that for any aircraft we are funding the operator has the appropriate licence, insurance and training. While that drone is financed we are liable for any fines it incurs under the Civic Aviation Authority,” How says.

“If a drone went into regulated air space while under our finance agreement, that drone would be our responsibility. So, we make sure that when we write any agreement, we ensure they have the appropriate licence, insurance and training.”

Ultimately, the critical factor in all of these regulatory issues is the safety of operation of the drone itself, but beyond regulatory challenges, there are also issues around public opinion.

“As well as regulation, public acceptance of ‘drone’ operations, especially for BVLOS (‘beyond visual line of sight’ from the operator or controller) is not yet established,” Blundell says. “With much of the UK, in particular, consisting of built-up areas, factors such as safe operation, charging and landing infrastructure, safe flight corridors, insurance and more will all need careful planning and a whole new ecosystem to support regulatory and public acceptance.”

From a more pragmatic angle, the question is not just a regulatory one, or one of public opinion. It is a question of the practicalities of financing a completely novel product.

“We have been financing drones for a little while,” How says. “The most popular form of asset finance here is to place it under OpEx. People assume the return on their investment for a drone will not be an instant one, so an OpEx model will see the return quickly.”

Arranging a sensible finance solution is made more complicated at a time when the industry is still awash with venture capital that is not always wisely invested.

“It’s not secret there have been casualties in the sector from a hardware and operator perspective,” Luen reflects, pointing out the recent well-documented bankruptcy filing from drone company PrecisionHawk.

“They raised an absolute fortune, but couldn’t find a viable business model. Sky-Futures was another major casualty in the UK. It is not enough to raise funding, you need to invest in the right things at the right time.”

To see the industry grow, Luen argues it needs streams of investment from the government that do not just dump money in the sector, but ask for accountability on what that funding will deliver.

“To hand out money to inexperienced people with a crazy idea is folly because that money is wasted,” Luen says. “It has to go to people with a strong business case, who know what they’re doing with it.”

Yet, when it comes to financing the drones themselves, How argues that in practical terms it is ultimately much like financing any other expensive piece of equipment.

“I wouldn’t say there are any unique challenges,” How says. “We tend to find that a large proportion of the financing for drones is for newer businesses, so it is higher risk. It tends to be people who have worked for a large corporation in the past and have gone freelance. So there is a credit risk there. We need to ensure we do our due diligence, but we have been financing drones for quite a while and treat it as any other asset finance.”

One sector that drone finance has something in common with is the EV sector. Both sectors are, on the face of it, conventional finance propositions, but as new technologies, there are unanswered questions around them.

As Blundell says, “From a funder’s perspective, rapid technical advancements make predicting residual values of such assets challenging, especially when there is often a generational shift in asset capability – like range and payload - in short time frames, leading to obsolescence of existing platforms.”

In the face of this, Blundell argues, “It will be important to look principally at the quality of counterparty, underlying cashflows and contracts as a basis for any lending decision, most notably in the early phases of operation.”

At COPTRZ, Luen finds that many of their customers are opting for perhaps the simplest of financing solutions.

“The business case is compelling. Lease purchase is a way of doing it. we have a finance partner on board, but we find most of our clients buy outright,” Luen says.

Luen agrees, however, that residuals remain an issue.

“Technology is advancing at such a rapid state that the clarity on residual values is lacking,” he says. “We don’t see that as a challenge to companies investing in technology.”

Bluestone, meanwhile, has found that Purchase Hire models are proving popular. “We write most of our agreements on a hire purchase, so that at the end the customer has the full title on all their drones,” How says. “The life expectancy of those drones could easily be longer than the three years of the agreement.”

Again, this model also suits financiers when the resale value of used drones remains unpredictable. “In future that is something we want to adopt and push out, but at the moment we’re unable to predict those values,” How says.

But while residual values remain a sticky subject in the EV sector, particularly around continuing battery technology development, How is a good deal more optimistic about our ability to track drone resale values.

“We do a lot of work around residual values in the technology space, and in that sector, it is much easier to forecast something after two or three years,” he says.

“In terms of the drone sector, I feel if we are in a position to forecast residual values that would open up some great offerings. The total cost of ownership would be lower and it would allow better lifecycle management for drones, But as we talk right now, in the current market we don’t have those values and don’t know what those values will be.”

One of the biggest blows to the EV sector was when Tesla’s EVs dropped their RRP by nearly a quarter overnight, stinging customers looking to swap out from a PCP. Sudden changes like that will remain a risk for the drone sector until it becomes more stable and established.

“In the next two to three years, potentially, when we have a stable hold on the market, we may offer residual values,” How predicts.

The path forward

The regulatory and finance situation is continuing to evolve and create new solutions, but while that is happening the technology and the market continue to move quickly.

“We are continuing to develop the use cases, to show the industry the social proof of the transformational benefits of the technology,” Luen says. “Major hardware developers continue to improve their features capability. We will see more endurance, greater payload capability, connectivity and software data utilisation. We are continually evolving to unlock new beneficial use cases.”

Luen points to continuing growth in the military, public safety, police, fire and rescue sectors, as well as infrastructure and surveying work such as power line inspections, and even agriculture.

“It’s so wide-ranging,” Luen says. “I don’t think there is going to be major progress around the delivery sector for some time. It relies on so many things around the aerospace sector. But we may see niche applications around medical deliveries. In the logistics sector, drones have been adopted by Amazon for warehousing operations. The use cases are just huge, with strong growth across all sectors.”

As that growth continues, the finance sector is keen to be involved.

“The technology will be adapted to more sectors and Bluestone will adapt to help them,” How forecasts.

Blundell agrees, “At Close Brothers, we are keeping a keen eye on developments in the sector and look forward to supporting its inevitable growth over the coming years.”